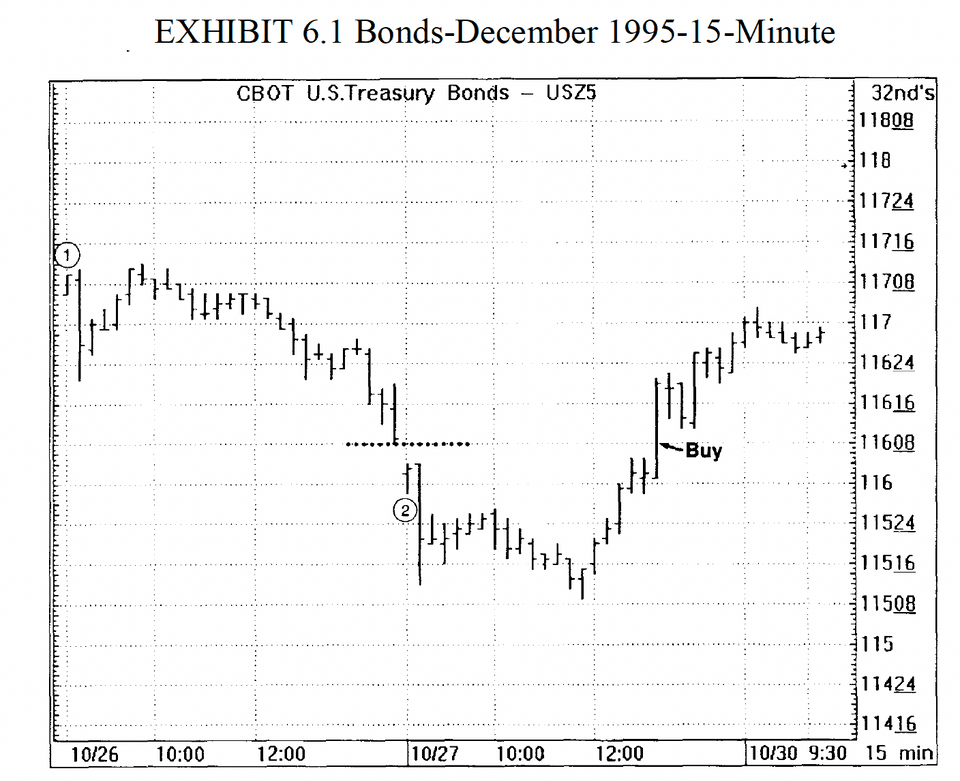

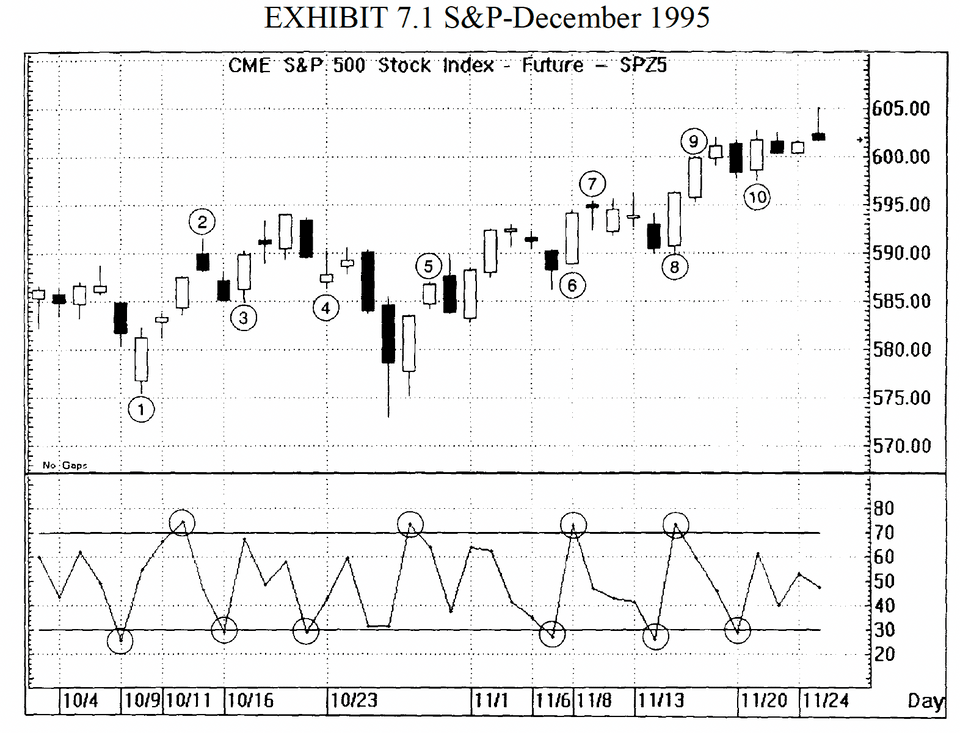

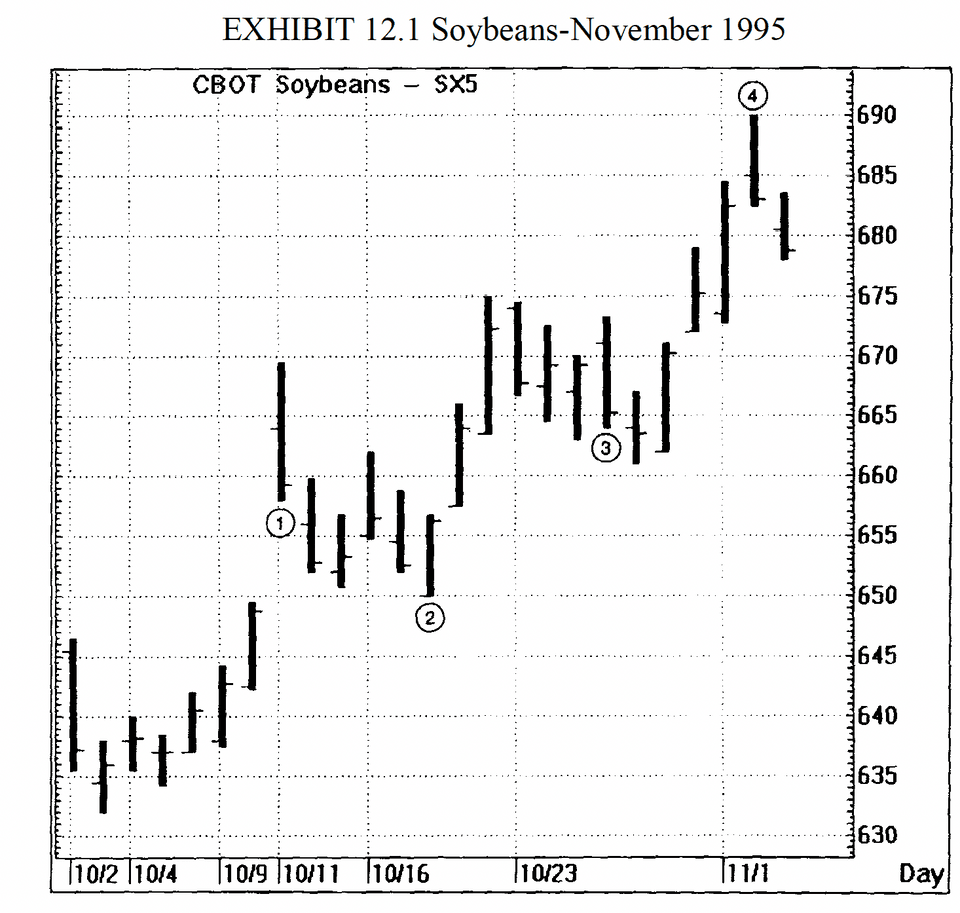

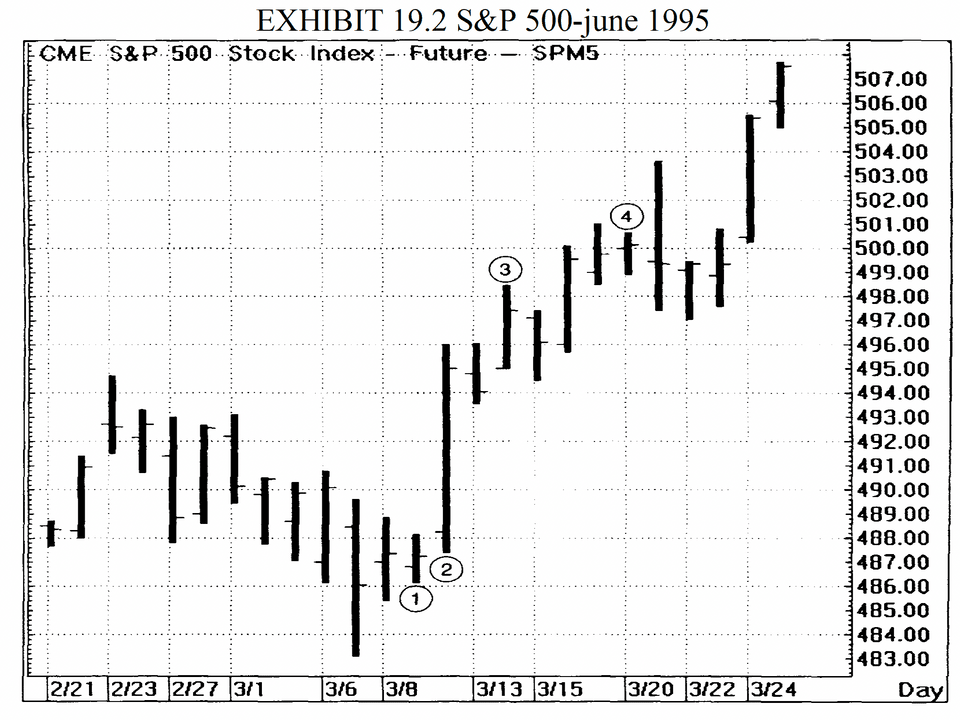

The strongest pattern in swing trading is trading on tests of previous highs or lows. These tests form a "double stop point," and offer ail excellent trade entry location with the least risk of loss

The final type of trade is a climax or exhaustion pattern.

page 6

Here are some of the other basic tenets of swing trading: 1. Stay in one time frame! 2. When in doubt, get out! 3.Don't trade in quiet, dull markets; 4.Finally, remember that both in short-term trading and mechanical systems, the distribution of winners is skewed. Most of a month's profits might come from only two or three big trades. Much of the time the individual profits may seem small, but more importantly the losses should be small, too.

page 8

Unlike long-term trend followers, short-term traders rarely make a large sum of money on any one trade

page 11

Ultimately, the way to minimize risk is to be in the market the shortest amount of time. The longer you are in the market, the more exposure you have to "price shocks" or unexpected adverse moves. As the markets get noisier and noisier, there are more frequent reactions. If you don't take your profits when you have them the market will usually take them back.

page 14

In our opinion, the overwhelming reason that traders win or lose is not because of their entry method, but because of their money management skills. By money management we simly mean keeping loses and draw downs to an absolute minimum while making the most of opportunities for profit.

As important as money management is to all investors, it is even more important to short-term traders. Unlike long-term trend followers, short-term traders rarely make a large sum of money on any one trade. Therefore, unlike the trend follower who tolerates a large drawdown in exchange for the possibility of hitting a home run, the short-term trader must keep his losses to a minimum to ensure his survival. If you keep your looses to a minimum on every trade, you will have 80 percent of the battle won.

page 12

Some useful short term strategies from this book:

TURTLE SOUP:

- Entry: If the current bar's temporary low point T (not closed) falls below the low point O of the past 20 bars, then place a limit buy order 0.05-0.1 above the low point O of the last 20 days. The stop-loss point is the low point T of today's bar. [The buy order is a touch-buy order.]

- Note: The low point of today and the low point of the past 20 days should have a time gap. It's not advisable to have the low point of the past 20 days occur just yesterday and then buy today if a new low is reached. Generally, it's recommended to have a time gap of around 4 days. In other words, you need to ensure that the action of reaching a new low occurs within a consolidated period.

TURTLE SOUP PLUS ONE:

- Entry: If the low point T (already closed) of the previous bar falls below the low point O of the past 20 bars, and the close of the previous bar is lower than the low point O of the past 20 bars, then place a limit order to buy above the low point O of the past 20 days, around 0.05-0.1 above it. The stop-loss level will be the low point T of the previous bar. (The order placed for buying is referred to as a "touch-buy" order.)

- Note: There should be a time gap between today's low point and the low point of the past 20 days. It is not advisable to buy if yesterday just marked a 20-day low and today's low is even lower. Typically, this time gap is considered to be around 4 days, ensuring that the new low is not an immediate reaction to the previous low. After entering a position, it's possible to take partial profits within 2-6 bars.

80-20 FOR DAY TRADE:

- Entry: If yesterday's opening was in the top 20% of the daily range and closed in the bottom 20% (forming a large bullish candle), and today's opening is lower than yesterday's closing, place a buy order at yesterday's closing price with a stop loss at today's low point up to that point.

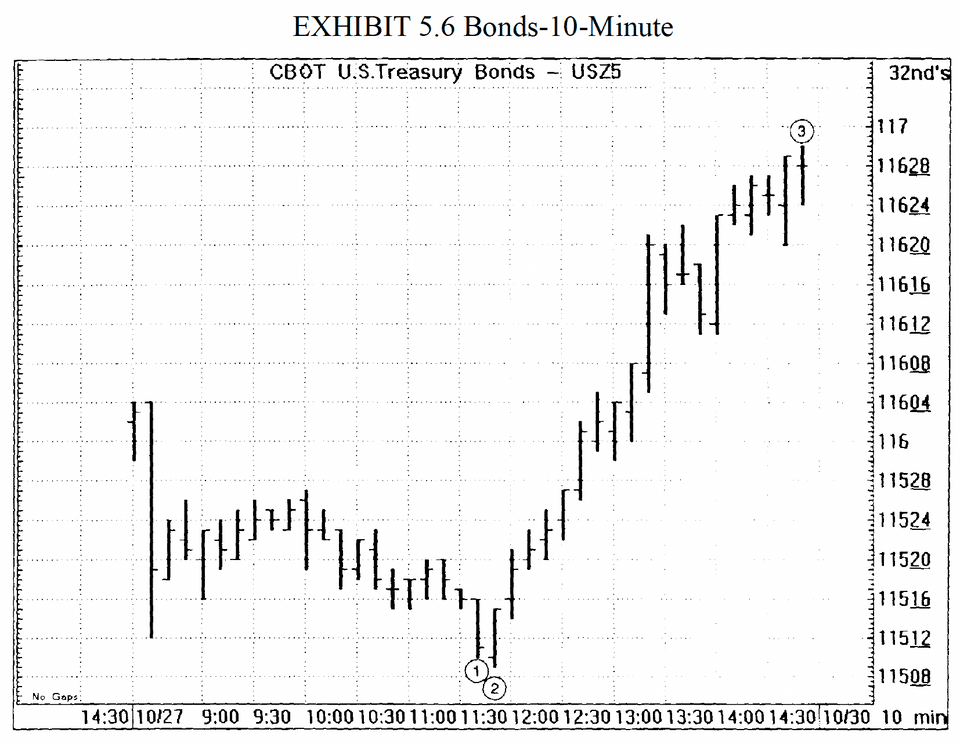

MOMENTUM PINBALL:

- Define LBR/RSI = RSI(ROC(CLOSE, 1), 3)

- Entry & Exit/Long: (a). Day-1 is determined by an LBR/RSI value of less than 30; (b). On day-2, place a buy stop above the HIGH of the first hour's trading range. Upon being filled, place a resting sell stop at the low of the first hour's range to protect your trade. The market should not come back to this point; (c). If the trade closes with a profit, carry it oven-tight. Exit on morning follow-through the next day (day-3). Be sure to exit this trade by the close of the next day. Taylor would look to exit a long trade "just above the high of the previous day."

- Entry & Exit/Short: The rules for shorting are the opposite of the buy rules. Day one is determined by an RSI value greater than 70. Place a sell stop below the LOW of the first hour's trading range. A protective stop should always be placed AT the extreme of the bar of entry and then trailed to protect any accrued profits.

WHIPLASH:

- Entry: If the stock opens lower today but rallies during the day, closing above 50% of the daily range, initiate a buy position at the closing price.

- Exit: If the follow-through doesn't work the next day, sell at the market open. If the follow-through occurs, use a trailing stop to capture profits and exit the position.

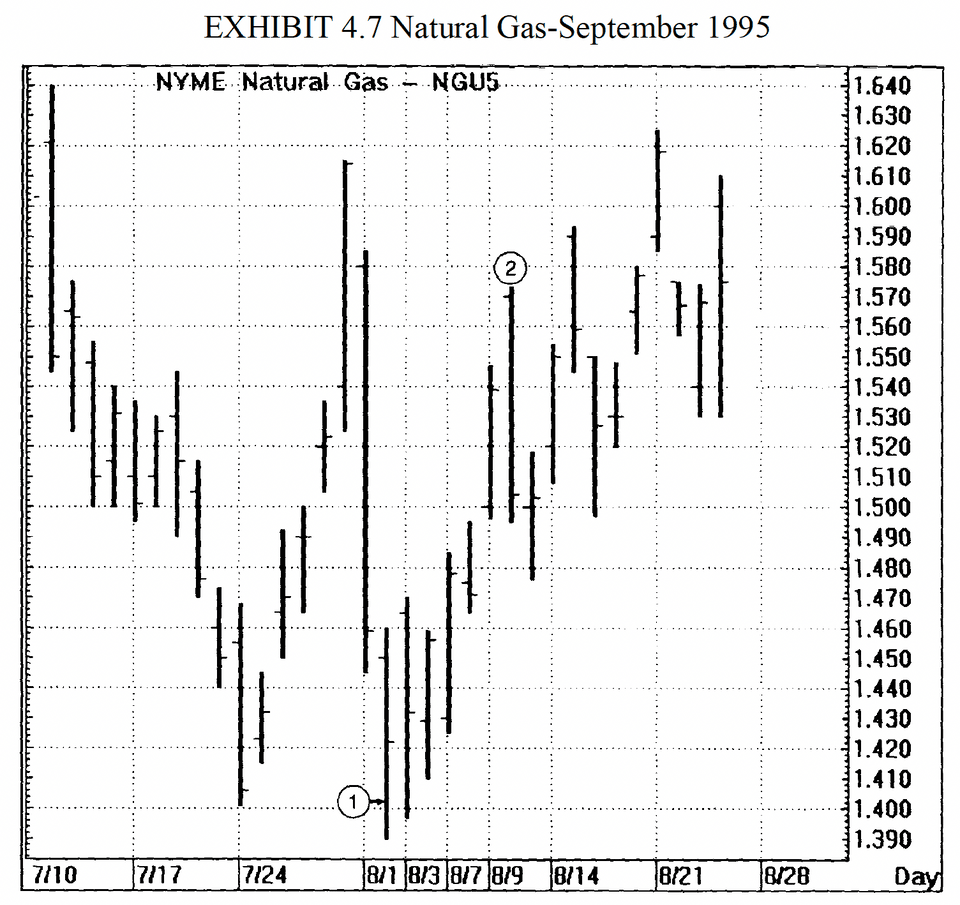

THREE-DAY UNFILLED GAP REVERSALS:

- Entry: If today's market gaps down and the gap is not filled, place a touch buy order at today's high over the next three days. If the buy order is executed successfully, set a stop-loss order at today's low.

- Gap Up: Go short; Gap Down: Go long (essentially betting on whether the gap will be filled in the next three days).

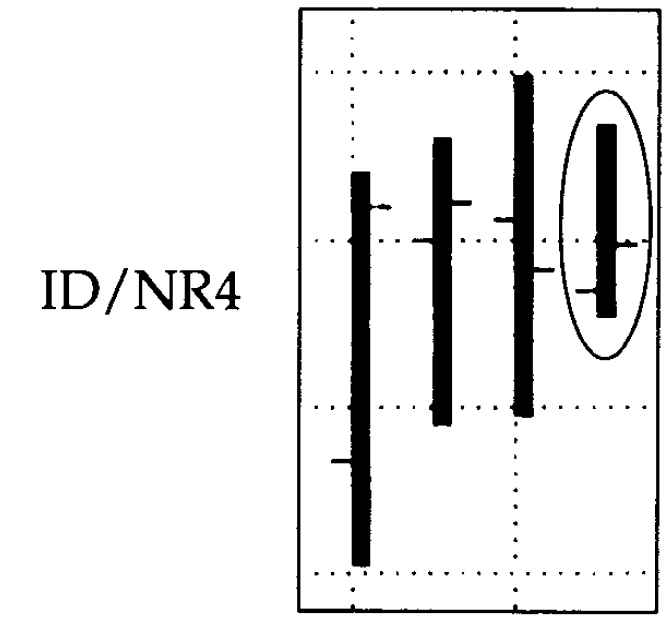

RANGE CONTRACTION: ID/NR4 and NR7:

- An NR4 is a trading day with the narrowest daily range of the last four days(including today). An inside day has a higher low than the previous day's low and a lower high than the previous day's high. Combining the two conditions sets up an ID/NR4 day.In the breakout mode we can't predict the direction in which we are going to enter the trade. All we can do is predict that there should be an expansion in volatility. Therefore, we must place both a buy-stop and a sell-stop in the market at the same time. The price movement will then "pull us into" the trade.

- Entry (Long only): After today's market close, identify stocks with an Inside Day (ID) and Narrow Range 4 (NR4) pattern. Before the market opens on the next day, place a buy entry order 10 ticks above today's high. Set the stop-loss for this long position 10 ticks below today's low.

- If this position doesn't generate profits over the next two days and hasn't been stopped out, it suggests that the market might lack a strong trend. In this case, we'll exit the position by selling at the close two days later.4.We can replace ID/NR4 with NR7 and then follow a similar approach as described above for entry and exit.

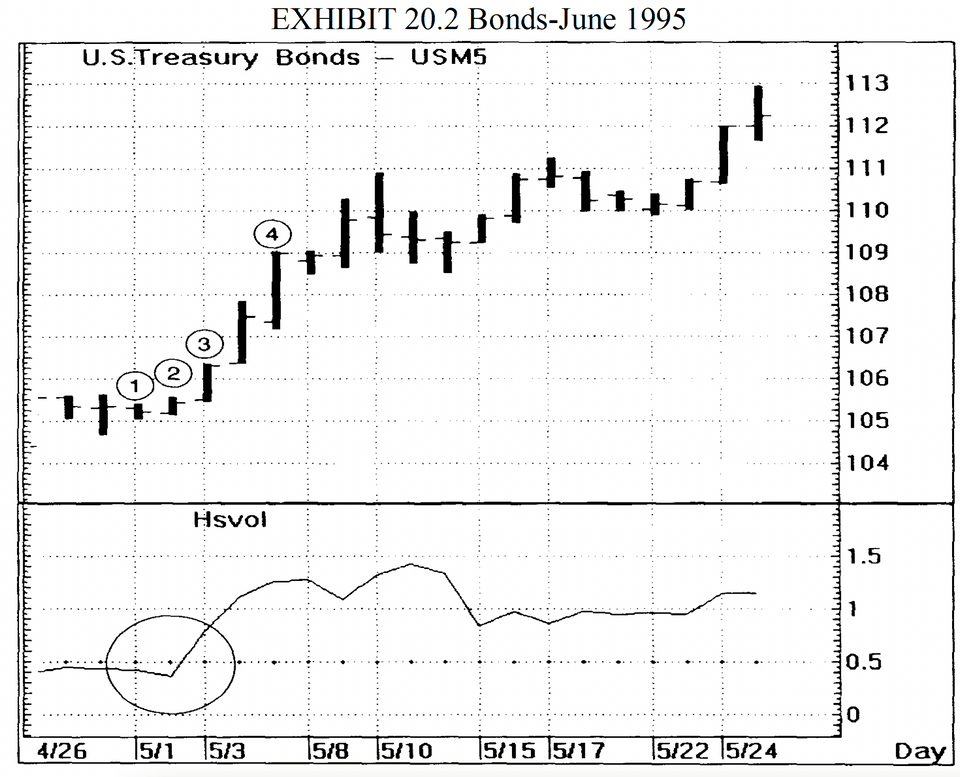

RANGE CONTRACTION: HISTORICAL VOLATILITY:

- HISTORICAL VOLATILITY RATIO: Use ATRP(10)/ATRP(50), which is the average ATRP over 10 days divided by the average ATRP over 50 days, to assess the current level of ATRP.

- Entry: If HISTORICAL VOLATILITY RATIO < 0.5 and today is an inside day (ID) or an NR4 day, then tomorrow is a buy day. The entry point is at today's high. The holding period is usually 1-4 days.