My wife and I are planning for our retirement. We only want to work for a while and have two or three decades to focus on our interests. The idea is excellent, but we still need some money for our bills during retirement. So we do a little bit of math on it.

Life span

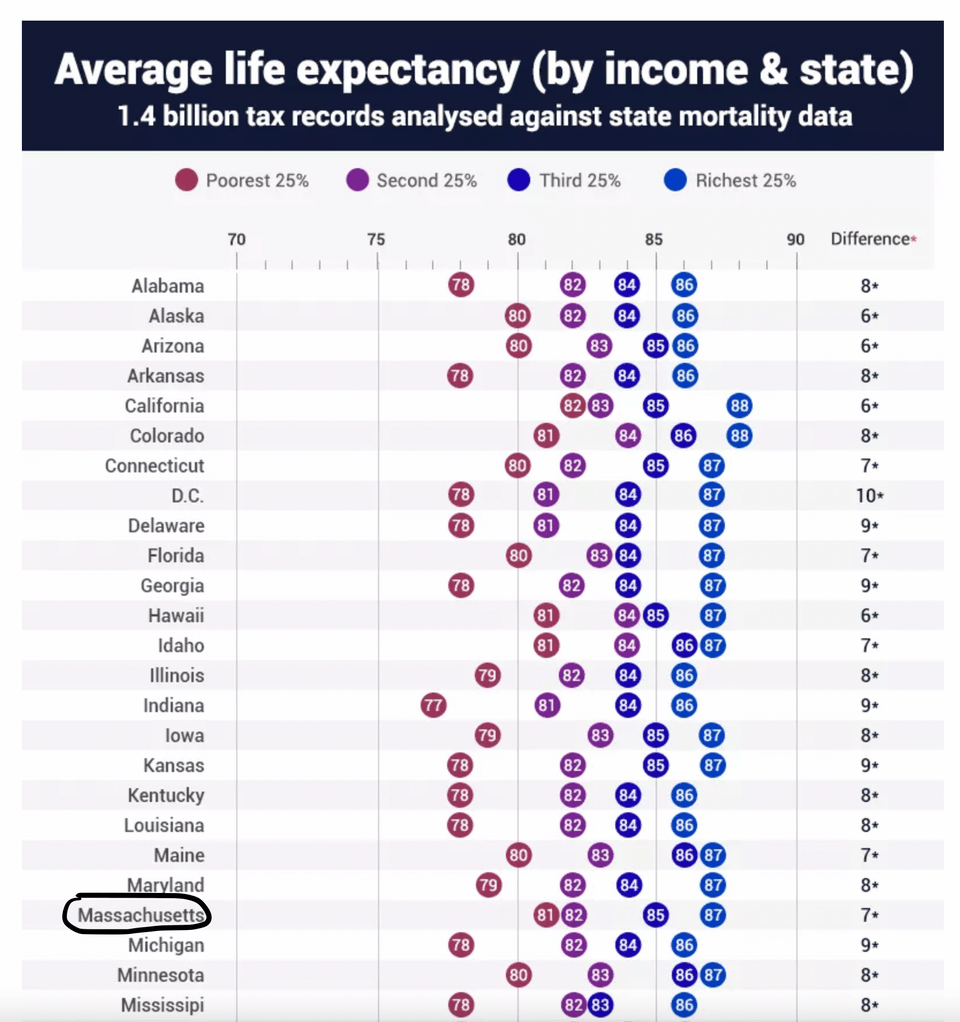

The first number you need worry about for retirement is not the saving (saving will come later), but the lifespan. However, estimating the lifespan of a particular person is not easier than predict the stock market. An article says that in Massachusetts, if the income is in the richest 25%, the life expectancy is 87.

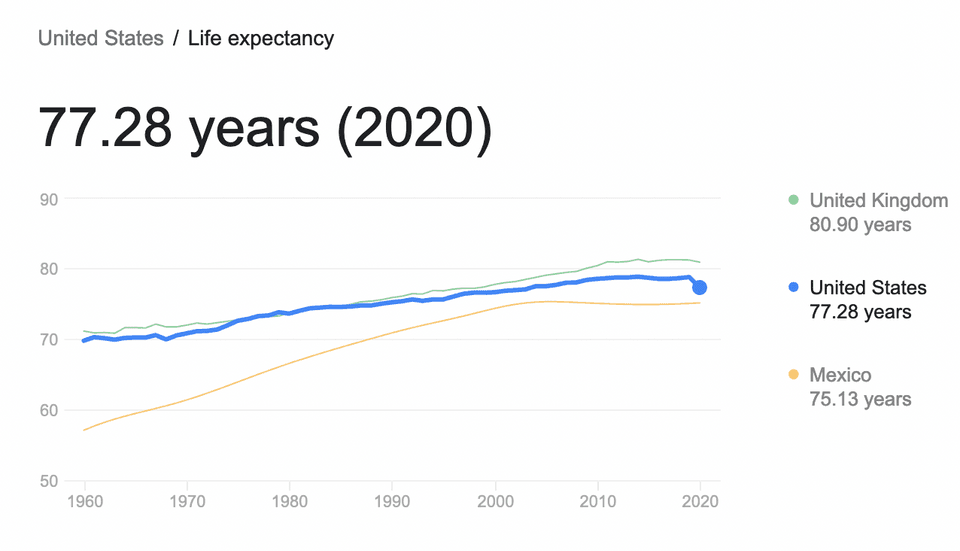

And with the advances in the caring industry, the average lifespan increases gradually. In the past 60 yrs from 1960-2020, the average lifespan of US increases 7.51 yrs. So In the next 60 yrs, a good guess is that 90-year is the typical lifespan for a modern human being.

Interests

- Sports: My wife would like to have some extreme sports and I agreed on that (even through it seems quite odd for an old man/woman to have such a choice). Swimming, ice skating, and roller blade is pretty good for exercise and body balance, but not a perfect candidate for having fun. We are considering

skiing,paragliding, andsurfing. - Investment: Of course I will do investment for my whole life. It is very exciting to see how high the account can shot.

- CG: I like 3D artistic things in general, but might still takes time to figure out what I really want put in to my retirement plan.

- Reading/writing: I am not enjoying writing for other people, but I do enjoying writing for my self. Reading is my interest in general, but I guess the life is too short to read all the interesting books in the world.

Money

OK. Now we have arrived at the money part, and we need to start to deal with some simple but confusing math.

Inflation

The single most important thing to take into consideration about money in a long time horizon is inflation. If the Fed printing money in a faster speed than the speed of chicken laying eggs, then we have inflation.

We can never know exactly the buying power of a 10-dollar bill in the next 50 years. However we can estimate it from the past.

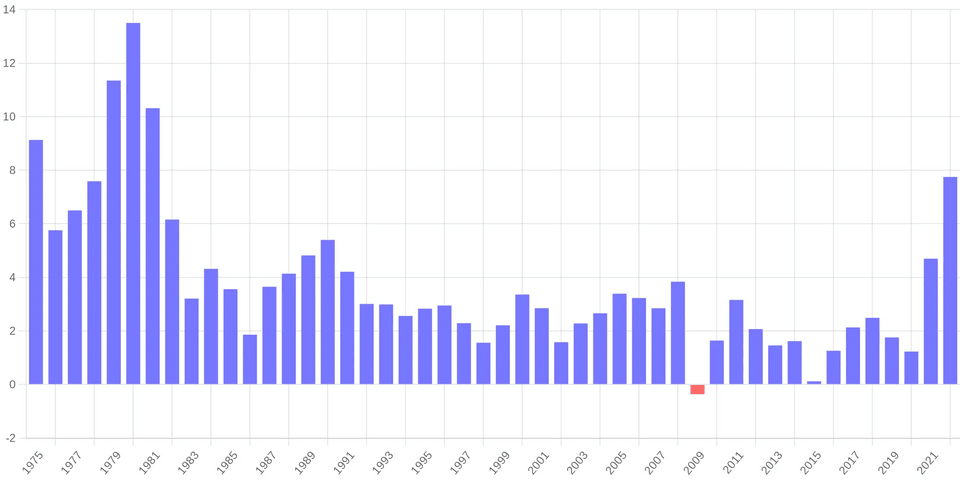

Inflation Rate between 1975-2022 | Inflation Calculator

This article states that during the past 47 years (why since 1975? since then Fed can printing us bucks for free!), the US dollar devalued A LOT. Every year, the money devalued by 3.8%.

This math told us if one dollar can buy a fresh egg for now, we only can buy 0.17 egg after 50 yrs.

The annual cost

According to my past ten years experience in US, I know that 100k per year is needed for a decent life. Be careful that 100k here is the money in 2022, not the future money. For example if we retire when we are 55 (2044 AD), we need 237k (furture dollar) annually for having the SAME quality of life in 2022 with 100k (Thanks to Fed)

Saving

For now we can only save 80k per year. We might be able to buy CDs (certificate of deposit) to have some interest to fight against inflation, but we do not have a method to fully cover the impact of inflation. Real estate investment might be a good way to ride the inflation.

Investment

Thanks for the past years, we successfully collect 250k in investment accounts (ROTH IRA and crypto). We will continue to use them to invest in markets. Each year we will add around 20k to investment accounts. Meanwhile we also invest 10k per year in projects, hoping to having a positive revenue in the future.

Math

- Suppose we need to pay for year’s bills during our retirement, and years are waiting for us to retire;

- The inflation is per year from now on, and each year in retirement we need to spend amount of current money for a living.

- Before retirement, we can save per year in that year’s money, and we agree to put all saved money in CDs to earn interest rate per year.

- Before retirement, we have initial capital and we add per year to the investment account. Each year's return is .

-COST: In the first year of our retirement, we need , and in the second year of our retirement, we need ,…, and the final year of our retirement we need . If we sum them up, we have the total cost during our retirement in retirement year’s money.

If we set (million), , . We have the following results:

- q = 0.02, (million)

- q = 0.03, (million)

- q = 0.04, (million)

- q = 0.05, (million)

-SAVINGS:

- B = 0.05, (million)

-INVESTMENT:

- r = 0.10, (million)

- r = 0.15, (million)

- r = 0.20, (million)

- r = 0.25, (million)

If we set (million) and (million),

- r = 0.10, (million)

- r = 0.15, (million)

- r = 0.20, (million)

- r = 0.25, (million)

So If we mark , then we need to have enough money to retire.

Conclusions

In two cases we can retire at time: If we can contribute 40k every year and we have , or if we can contribute 20k every year and we have . The overall message is that we need to keep our long-term investment return around .