At the end of the movie 'The Face Reader,' Song Kang-ho uses the concept of 'Physiognomy' to reveal the essence of many things:

I see people's facial characters, yet I haven't seen the wheels of history; it's akin to only seeing the ever-changing waves. In reality, what should be observed is the direction of the wind, for the waves rise due to the wind.

In fact, this passage also reveals the essence of speculation and the misconceptions we should avoid.

Engaging in bullish trading on a smaller time scale must always align with bullish trends on a larger time scale, rather than the other way around. In other words, it's wise to enter into bullish positions on the smaller scale only when the overarching trend is bullish. If the prevailing trend is bearish, attempting bullish trades can easily result in getting trapped or necessitating stop-loss exits.

In the context of the time frame of scalping: people's facial characters are akin to price fluctuations on a 1-minute time scale, while the wheels of history are represented by the moving averages on a 15-minute time scale. The momentary ripples of change on a 1-minute scale are highly likely to align with the moving averages on the 15-minute time scale. Therefore, if there's a bullish trend on a higher time scale, the ripples of bullish movement on the lower time scale will rise more vigorously, while bearish movements will likely be short-lived.

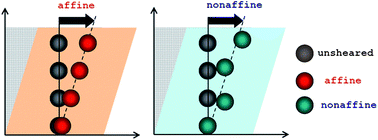

This principle exhibits a notable parallel to deformation in solids. While microscopic deformation doesn't always perfectly mirror macroscopic stress due to the presence of unavoidable non-affine deformation in certain areas, predicting the microscopic deformation in alignment with the macroscopic direction significantly increases our chances of success if we venture to guess.

Many times, as speculators, we wish to capture the absolute bottom of a trend, and then ride the trend to significant profits. However, reality dictates that if we aim to catch the bottom, we need to build our position on the left side of the trend. This means enduring the anguish that comes with entering early. The same applies to short positions. Opting to enter on the left side of a trend necessitates a constant awareness that being ahead of the curve frequently accompanies significant discomfort, stress, and pain.